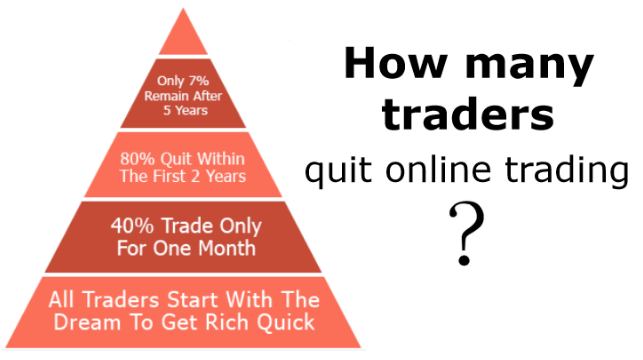

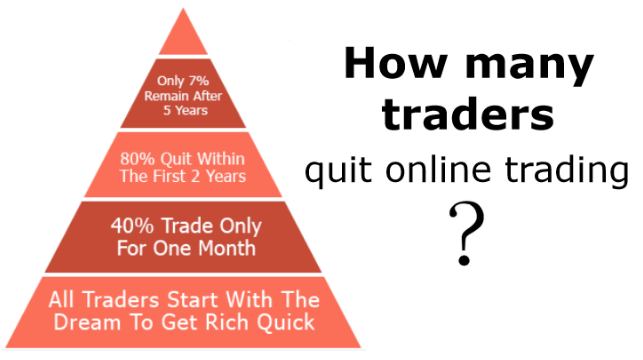

How many traders quit online trading?

Trading has always been a challenging and ever-evolving industry that requires a lot of time, effort, and skill to be successful. Despite numerous opportunities, statistics show that a vast majority of traders quit trading at some point in their career. In this article, we will explore the reasons behind trader’s failure and the overall success rates in trading.

The Reality of Trading

Trading is not as easy as portrayed in the movies or media. While it may seem like a quick and easy way to make money, it requires a deep understanding of the financial markets, the ability to manage risks effectively, and patience to weather the ups and downs that come with it.

The financial markets are inherently unpredictable, and there is always a significant risk of losing money. According to a recent study conducted by the Autorité des Marchés Financiers (AMF), 90% of traders lose money in the first year of trading. This statistic is an eye-opener, but it does not come as a surprise to traders who understand the harsh realities of the industry.

Why Do Traders Quit?

The answer lies in the complexity of trading and the expectations of novice traders. Many traders come into the industry with unrealistic expectations of making quick profits and fail to realize that trading requires skill, patience, and a long-term perspective.

Moreover, the majority of traders lack the necessary skills to succeed in the trading industry, and many do not invest in their professional development. They do not take the time to learn the fundamental principles of trading, technical analysis, or risk management, which leads to making costly mistakes.

Another factor that contributes to failure in trading is the lack of discipline, self-control, and emotional management. Traders who let their emotions take over in the face of losses or gains tend to make irrational decisions that further exacerbate their losses.

The end result is a high level of frustration and disillusionment, which leads many traders to quit trading.

Success Rates in Trading

Despite the high failure rates, there are traders who have been successful in the industry. However, the percentage of successful traders is relatively low compared to those who fail. According to a study conducted by the Financial Conduct Authority (FCA), only 12% of retail traders make a profit in the long term.

The majority of successful traders attribute their success to discipline, patience, sound risk management practices, and continuous learning. They are also aware of the harsh realities of the industry and do not let their emotions dictate their decision-making process.

Conclusion

In conclusion, trading is not for the faint-hearted or those seeking a quick and easy way to make money. The industry requires discipline, patience, and a long-term perspective to succeed. While the statistics may seem daunting, aspiring traders can increase their chances of success by investing in their professional development, practicing sound risk management, and controlling their emotions.

Frequently asked questions

What percentage of traders are successful?

According to the FCA, only 12% of retail traders make a profit in the long term.

Why do traders quit trading?

Traders quit trading for various reasons, including lack of necessary skills, unrealistic expectations, and failure to manage emotions and risks properly.

How can traders increase their chances of success?

Traders can increase their chances of success by investing in their professional development, practicing sound risk management, and controlling their emotions.

Are there successful traders in the industry?

Yes, there are traders who have been successful in the industry. However, the percentage of successful traders is relatively low compared to those who fail.