Forex demo account : Demo accounts are the try before you purchase feature of Forex trading brokers. That said, I always advise new traders to treat a demo account even as you’d a live account for the subsequent reasons.

Best Demo Trading Account Forex Brokers

Broker Verified

CySEC, FCA

100% Deposit Bonus

USD 100

1:500

Broker Verified

FCA, ASIC, IIROC

Up to 20% Deposit Bonus

USD 100

1:500

Broker Verified

FCA, ASIC, CySEC

Demo of up to $100, 000

USD 100

1:500

Broker Verified

VFSC, ASIC

Low Spreads from 0.0

USD 10

1:500

Are the spreads tight? albeit demo accounts are a simulation, you would like to find out how margin trading works.

Does the broker support the platform you would like to use? If not, search for one that does.

Are you comfortable making the minimum deposit? If you opt to open a live account with this broker, are you getting to have the financial means to try to to so?

How long does the demo account stay open? Many demo accounts are time limited unless you open a live account. you ought to never feel rushed by a broker, so confirm you recognize the solution .

Demo Account Advantages

All sorts of CFD trading carry high risks. Alongside educating yourself, the simplest thanks to learn risk management in Forex trading is to use a demo account. If this is often your first time trading, it’s vital that you simply open a demo account before a live trading account. Other good reasons to use a demo account are:

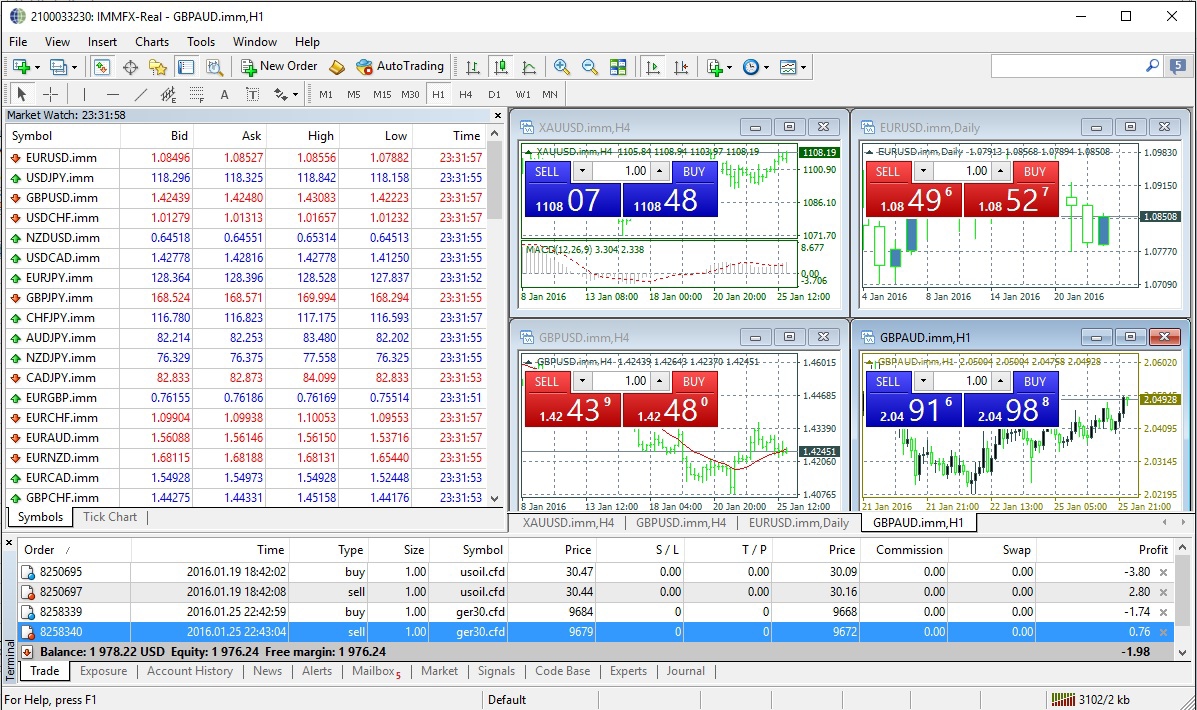

To test the platform

Mаkе sure thе Forex demo account offers everything you would like to simulate your strategy once you start trading real money. Trading platforms will offer you information about the live markets, historical data to incorporate in your analysis, economic calendars to spot upcoming news events, quote information and an order window to form your trades.

To test the broker’s service

All Forex brokers will tell you that they need the simplest level of service, but some are better than others. once we compare levels of service, it’s not almost what percentage hours the customer support office is open for, but rather if you’re assigned a fanatical account manager, or if you’ve got access to a analyst to debate your trades with. altogether fairness, you’ll likely not get both of those if you’ve got not made a deposit, but during your conversations with the broker, while you’ve got your demo account, you’ll ask about these sorts of perks.

To download any educational material

A demo account is your opportunity to find out during a hands-on, risk-free environment. Most brokers will throw open the doors to their educational content. It might be ebooks, short videos, webinars, or maybe premium subscription material so take the chance to find out from them, so you become better at developing a trading plan, spotting opportunities, sizing the order right and maintaining strict risk management.

To decide if Forex Demo Accounts is for you

Once you’ve got had an opportunity to use the trading platform, started reading about what it takes to be a successful trader, and tested the extent of engagement you’ll get from the broker, you ought to be ready to decide if you enjoy Forex trading. If you’ve got no pleasure in trading, it’s probably not your thing. But if you discover the markets interesting, enjoy the analysis, and find satisfaction in each trading session, you’ve got successfully used your demo account, and you’re able to become a live trader.

Are Forex Demo Accounts Accurate?

From a statistical perspective, yes they’re . Demo accounts use an equivalent live market data as live accounts.

Where they’re less accurate is within the psychology of the trader. In live trading there’s an ever-present fear of losing, and this encourages the trader to guard themselves by being diligent with setting order types, or by making additional leverage calculations to urge the danger exposure correct.

But with a demo account, there’s an absence of this fear because the cash isn’t real. Therefore, from a psychological aspect, your behaviour won’t accurately reflect the truth of trading with a live account, with real financial consequences.

Iѕ Fоrеx Trading Risky?

As with any speculative trading, there are risks to Forex trading. Forex trading uses leverage – borrowed money from a liquidity provider to inflate the dimensions of your traded investment. If you were to trade without leverage, the movements within the market would be too small to form an outsized profit from; but it’s due to the amplified effect of using leverage that level of risk is so high. If you lose a leveraged trade Forex trading, you’re liable for paying the complete loss from the balance in your trading account.

That said, yоu can аlwауѕ set a lіmіt tо thе downside оf any trаdе by employing a stop loss; dеfіnе thе mаxіmum lоѕѕ that you simply are prepared tо ассерt and limit your exposure to risk in trading. If you’re concerned about losing the investment that you simply are making, then you ought to consult a financial adviser to assist you opt what proportion you’ll afford to form as a deposit.